CoW Protocol(COW) ——抗 MEV 去中心化交易协议

什么是 CoW Protocol ?

CoW Protocol 项目简介

CoW Protocol 是一个去中心化交易协议,是一种完全无需许可的交易协议,它利用批量拍卖作为其价格发现机制。CoW Protocol 部署在 Ethereum 和 Gnosis 上,集兑换协议,集批量交易 (Batch Auctions)、意图 (Trade Intents) 与 MEV 保护等功能于一身,能够为用户提供优质价格,并在 Gas费和流动性提供者费用方面节省大量资金。

CoW Protocol 核心机制

MEV 痛点:

MEV(最大可提取价值)攻击是当前 DEX 一直以来面临最大的问题,目前的交易顺序是:

- 用户创建交易。

交易通过 RPC 端点发送到内存池。

验证者获取交易并执行。

这个过程存在一个问题:它使用户容易受到 MEV机器人的影响——机器人在队列中发现一笔大额交易,并抢先于该交易下单,利用预期的价格波动,抢跑于用户,从中牟利。这不仅会导致用户体验的严重下降,如遭遇抢先交易、三明治攻击等,还可能造成订单执行效果不佳。

CoW 协议通过其独特的交易模型,主要从以下两个方面为用户解决该问题

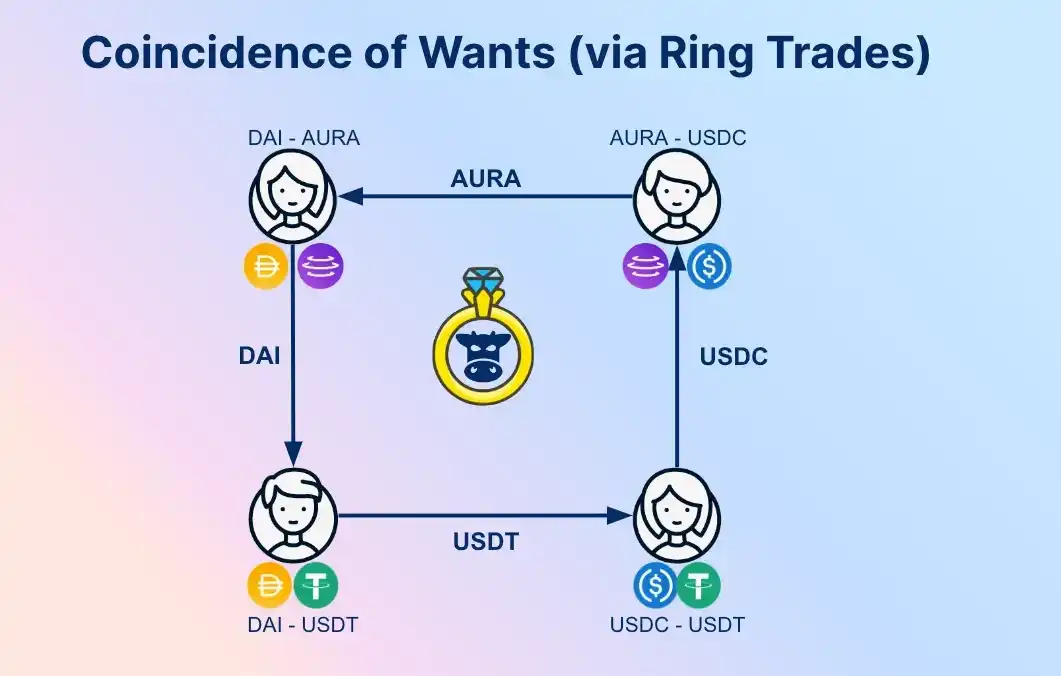

需求巧合

CoW Protocol 名字中的 CoW 是 Coincidence of Wants 的缩写,意为需求巧合,需求巧合是一种经济现象,双方点对点交换资产。在 CoW Swap 上,当两个(或多个)交易者相互交换加密货币而不必使用链上流动性时,就会发生需求巧合。传统的 MEV 攻击主要依赖于自动做市商(AMM)的价格动态。然而,当订单通过 CoW 进行点对点匹配时,它们完全绕过了链上流动性,从根本上杜绝了 MEV 攻击的可能性。

在 Uniswap 等传统去中心化交易所,交易双方会使用流动性池子进行交易,但在 CoW Protocol 上,还有另一种可能性。CoW Protocol 订单开始时是签名的「交易意向」消息,这些消息在发送到 Uniswap 等链上流动性来源之前被批量处理在一起。这样一来,CoW Swap 可以点对点匹配订单。

这也意味着,交易行为不需要通过流动性池,而是一种自发的点对点交易。这就节省了流动性提供者的费用和 Gas 成本,避免了滑点,并防止了 MEV 攻击。

需求巧合也就是订单撮合。

在交易的一方不能完全满足另一方的交易需求时,如果当前交易时段内没有其他人可以与他进行第二次 CoW 交易,那么该笔交易将通过 Uniswap 或 Balancer 等服务路由到链上流动性池,以填补他的剩余交易。由交易多方一起分担 Gas 成本。

为了满足交易的完整性和用户的多需求,CoW 设计了一种环形交易(Ring Trade)进行订单配对,将交易分解为多个部分,链下批量交易,从而减少用户成本。

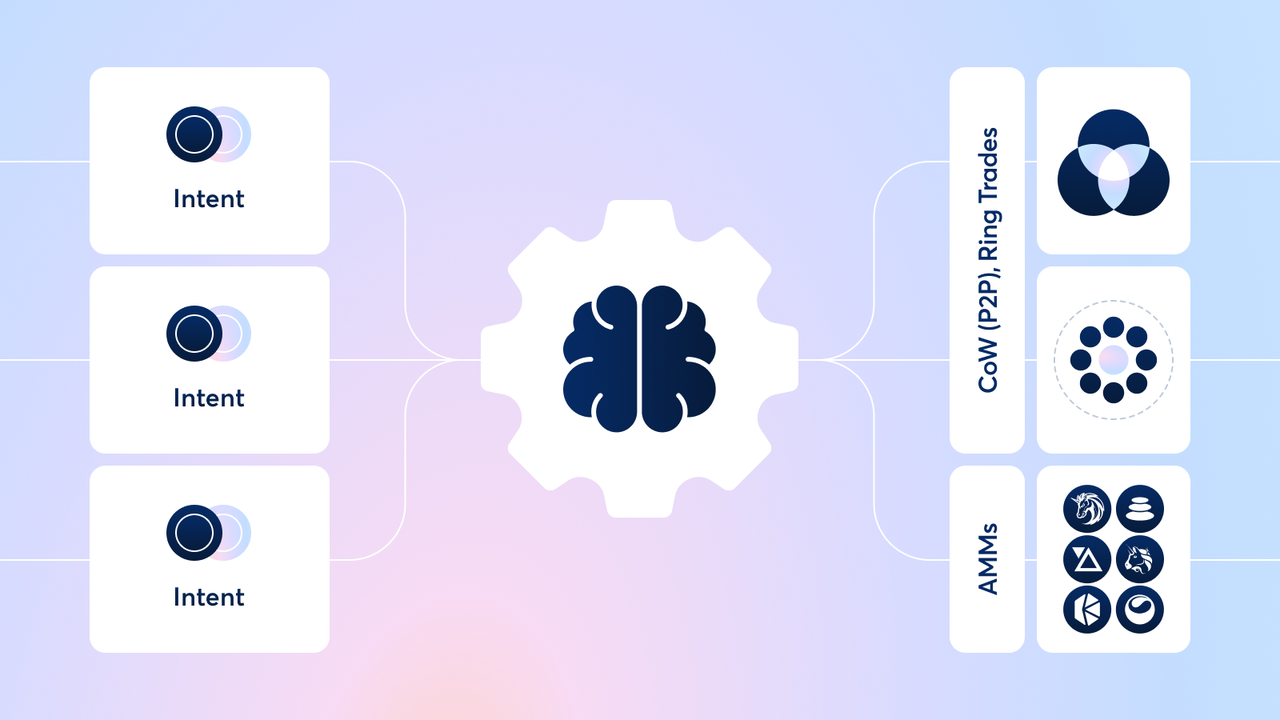

意图交易

CoW Protocol 引入了一种新的交易方式——意图交易。通过 CoW Protocol 进行交易时,并非直接下单,而是签署“交易意向”。这份意向会明确用户要交易的资产及数量,这些签名订单随后会在链下传递给被称为 Solvers(解算者)的专业参与者。这些求解者会在订单生效期间展开激烈竞争,力求找出最优的执行路径,而胜出的求解者将赢得执行该笔交易的权利。 因此用户无需关心交易的具体执行细节。

交易所需的 Gas 费由 Solver 承担,这意味着即使在交易未能成功执行的情况下(例如,在截止时间前未能找到满足承诺价格的路径),用户也无需支付任何 Gas 费用,有效降低了用户的交易风险。

作为专业方,Solvers 会精确计算每笔交易的最佳滑点,并尽可能通过 CoW 或私人做市商在链下匹配流动性,从而大幅降低 MEV 风险。

CoW Protocol 融资背景

- 2022–3,CoW Protocol 完成 2300 万美元融资,其中从 Blockchain Capital、Cherry Ventures 和 Ethereal Ventures 等筹集到 1500 万美元,剩余资金从 5000 名社区成员中筹集。同时,CowDAO 从 Gnosis DAO 中分离。

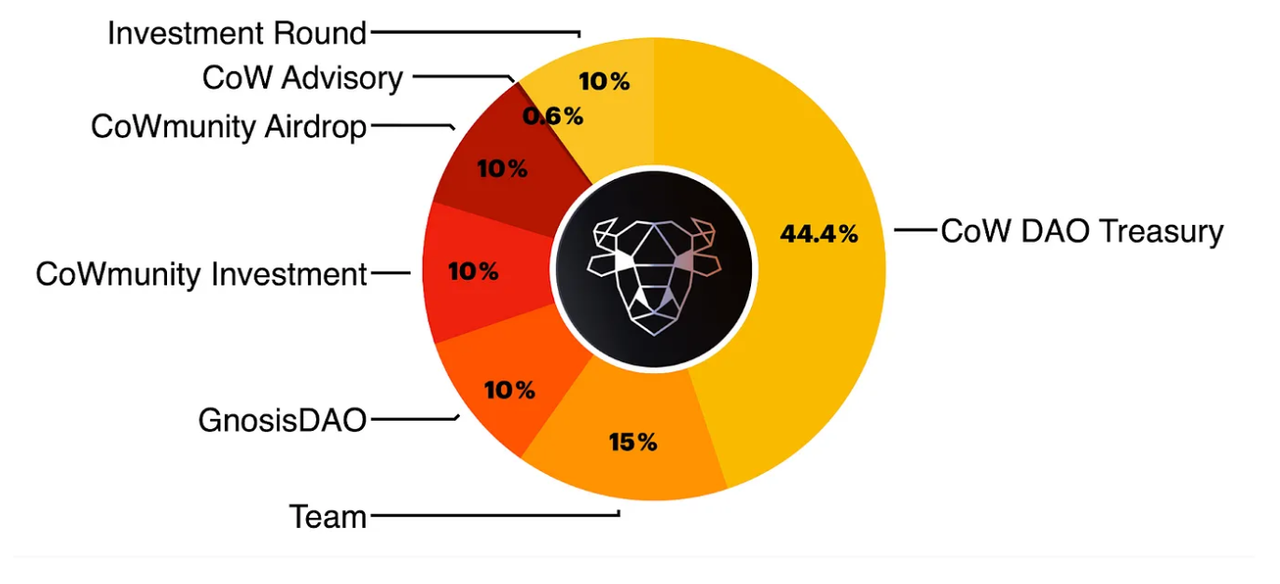

COW 代币经济学

CoW Protocol 是 CoW Protocol 的治理代币,旨在让用户对平台的未来有发言权。总量 10 亿枚,流通代币 9025 万枚,占代币总量的 9.02%

- 国库: 44.4%

- 团队: 15%

- GnosisDAO: 10%

- 生态发展: 10%

- 空投: 10%

- 协议发展:10%

- 提议奖励:0.6%